Dhaka residents complaining about sky-high prices of foods, especially vegetables, have been a common sight over the last several days.

In recent weeks, prices of most vegetables have shot up, hovering around Tk 100 a kilogramme (kg). For all latest news, follow The Daily Star’s Google News channel.

Prices of some vegetables have crossed the Tk 100 mark, further straining the budgets of low- and fixed-income families, who are now spending a large portion of their income on food.

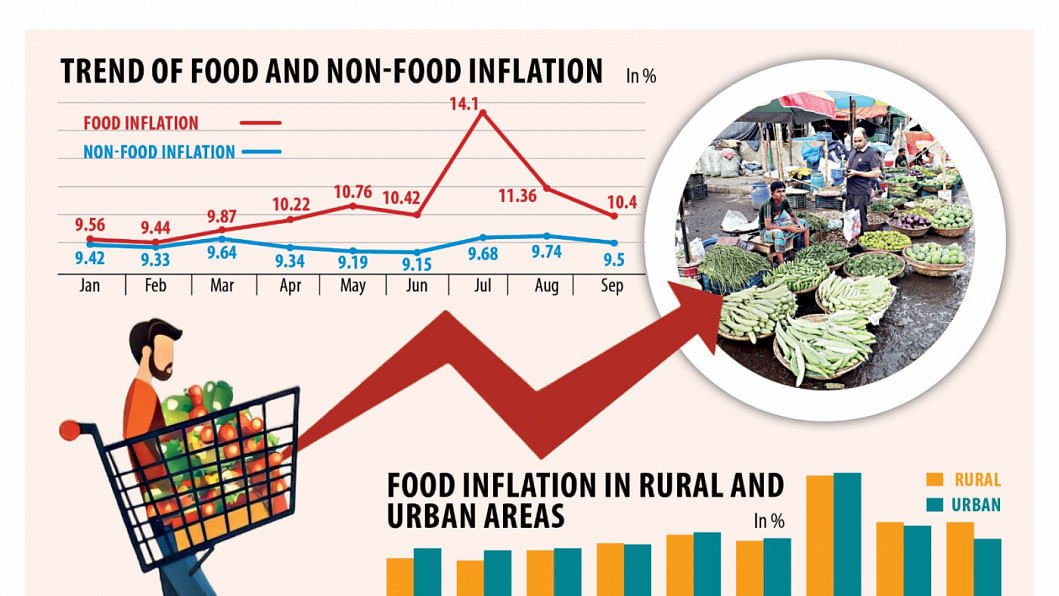

Food inflation has remained above 10 percent for six consecutive months since April this year.

Meanwhile, overall inflation stayed above 9 percent since March 2023, although the Bangladesh Bank has been raising the policy rate since May of the previous year to curb demand and control inflation.

Including a hike in the repo or policy rate to 9.5 percent last month, the BB increased the interest rate for the 10th time since May of 2022.

This raises the question of why food prices have remained stubbornly high and whether it is related to demand-induced inflation, for which the central bank has been raising its key policy rate to make the money costlier and reduce excess demand.

On this issue, a senior official of the BB said they have little to do in containing the food prices.

“We have found that food prices have risen due to supply-side problems such as the flood. Supply-side issues cannot be addressed with the policy rate,” said the official.

“Crops getting ruined after being submerged under flood is a different phenomenon. This has to be addressed by increasing the supply.”

In the last two months, overall food inflation eased, but the decline was not significant enough to ease pressure on the consumers’ wallets.

Last month, food inflation stood at 10.4 percent, down from 11.36 percent a month ago, according to data of the Bangladesh Bureau of Statistics.

Selim Raihan, a professor of economics at Dhaka University, said food prices cannot be controlled solely by raising the policy rate.

“You will have to wait if you want to see the impact of a higher policy rate on inflation. What is needed now is to increase the availability of food in the market. Prices will not decline without a significant increase in supply.”

The government should also remove import tariffs on food items at least for a specific period, to bring down the prices.

Increased demand for food during Eid-ul-Azha, along with supply disruptions, may have caused the surge in food inflation in the April-June quarter of 2024, Bangladesh Bank said in its quarterly report published at the end of last month.

“Heatwaves in April 2024 and Cyclone Remal in May 2024 significantly affected agricultural production, contributing to the rise in food prices.”

Food inflation increased significantly from 9.87 percent in March this year to 10.22 percent in April, remaining unfavourable to the consumers, which later hit 10.42 percent by the end of June, the banking regulator said.

“Global issues, including the ongoing Russia-Ukraine war, tensions in the Red Sea, and the Gaza crisis, further disrupted supply chains and led to a high production input cost.”

In the fourth quarter of last fiscal year, point-to-point food inflation surged both in urban and rural areas.

Devastating floods in the eastern districts and heavy rainfall damaged crop fields in August and squeezed the supply of vegetables.

At present, a similar kind of damage is now taking place because of the same two factors in the north-eastern districts.

Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development, said food is a basic necessity and it is not possible to significantly reduce demand by increasing the policy rate.

“The majority of the population lead their life above the subsistence level. So, the scope to bring down inflation by raising the policy rate is low. You have to increase the supply. This is a fiscal policy issue,” he said.

“The market here is not competitive which is why prices go up without any valid reason. The weakness in the value chain also needs to be addressed.”

Mujeri, a former chief economist of the BB, said the authorities concerned have taken many efforts to monitor the market and cut the scope of making high profits.

Traders are fined for wrongdoings, but this approach is neither effective nor adequate, he said.

When a fine is imposed, the trader simply raises prices for consumers to cover the cost of the fine, he added.

“You have to increase supply in the market and ensure competition.”

Ashikur Rahman, principal economist at the Policy Research Institute of Bangladesh, said higher food prices are closely related to price distortions occurring in the markets and the associated supply chain, where new political actors have emerged to exert undue political influence and extract economic rent.

“This issue needs to be addressed effectively if we want stability in the food prices.”

Both Mujeri and Raihan said the prices could be controlled if a coordinated and integrated approach is taken.

“The condition of the commoners is dire. Jobs and income opportunities have diminished due to the economic slowdown. We do not want to see a situation where essential commodities are beyond the reach of the average person. A coordinated effort must be made to tame inflation,” Raihan said.